AEMC releases latest Transmission Access Reform consultation

23 May 2024

The Australian Energy Market Commission (AEMC)'s consultation paper provides further details of a hybrid model for transmission access reform consisting of:

These reforms are part of a lengthy review of transmission access reform and congestion since 2018. There are significant implications for existing and future generation and energy storage participants in the National Electricity Market (NEM).

Interested stakeholders are invited to make a submission to the AEMC by 6 June 2024.

For more information on making a submission, refer to the Consultation Paper or get in touch.

In our view there are significant issues associated with the proposals (some of which have been raised previously in the debate on transmission access reform):

It is surprising that participants are being asked to consider a further new CRM model given the number of processes that have been undertaken on transmission access since 2018. It suggests that the issue will not be resolved in the near future and that it may ultimately be an out of date model as the market and government programs deal with the congestion issue.

Currently, the NEM has 'open access', meaning any generator that meets the relevant technical standards may negotiate a connection to any part of the network at any time, subject only to the network connection process with the relevant TNSP and input from the Australian Energy Market Operator (AEMO) on access standards and system strength. A generator may connect irrespective of whether the connection will provide value to, or cause congestion on, the broader power system.

Connected generators can submit offers to sell energy into the market, which are dispatched at the volume determined by the NEM's central dispatch engine. The central dispatch engine determines the output of each generator that leads to the overall lowest cost dispatch to meet demand while maintaining system security and avoiding violations of the physical limits of the system, otherwise known as constraint equations. Generators receive the RRP for their energy dispatched every five minutes – if a generator is not dispatched, it gets no access and is not paid.

The AEMC's paper attributes the following inefficiencies in the NEM to the linkage between access and physical dispatch:

The AEMC has identified the following objectives for transmission access reform:

The Energy Security Board (ESB's May 2023 consultation paper (see our previous article on this paper here) proposed a hybrid transmission access model, consisting of both:

The hybrid model remains the AEMC's preferred option for transmission access reform. Particularly, the AEMC expects the hybrid model would:

The hybrid model was assessed against six alternative models as providing the greatest efficiency savings, reduced capex and fuel costs.

The priority access mechanism assigns generators a priority level in the energy market during operational timeframes.

The ESB had identified that the preferable approach to implementing prioritisation is by bid price floor adjustments, where participants with different dispatch priorities are assigned different bid price floors (BFPs) that set the maximum bid that they can make in the access dispatch run.

In 2023, a testing program was set up using AEMO's CRM prototyping to understand the impact of implementing priority access in the NEM dispatch engine (NEMDE).

The testing demonstrated that soft prioritisation of generators may reduce cannibalisation outcomes compared to the status quo, without significantly increasing the RRP.

The AEMC is seeking feedback on four priority access model options that may give effect to the bid price floor adjustment approach, and assign generators to a limited number of priority levels. These are:

This approach involves grouping generators by year for the duration of prioritisation, before rolling them up into a higher priority group as the number of available priority models is met. There are intended to be 10 levels of priority, with BFPs ranging from -$200/MWh for the lowest priority to -$1000/MWh for the highest priority. Within that range, the BFPs could follow a geometric sequence such that the level of firmness between adjacent dispatch priority is somewhat constant.

Source: Australian Energy Market Commission

This model allows investors to have a good degree of certainty regarding their effective level of priority relative to incumbent generators and other generators seeking to access the same area of the network at the time of making a final investment decision.

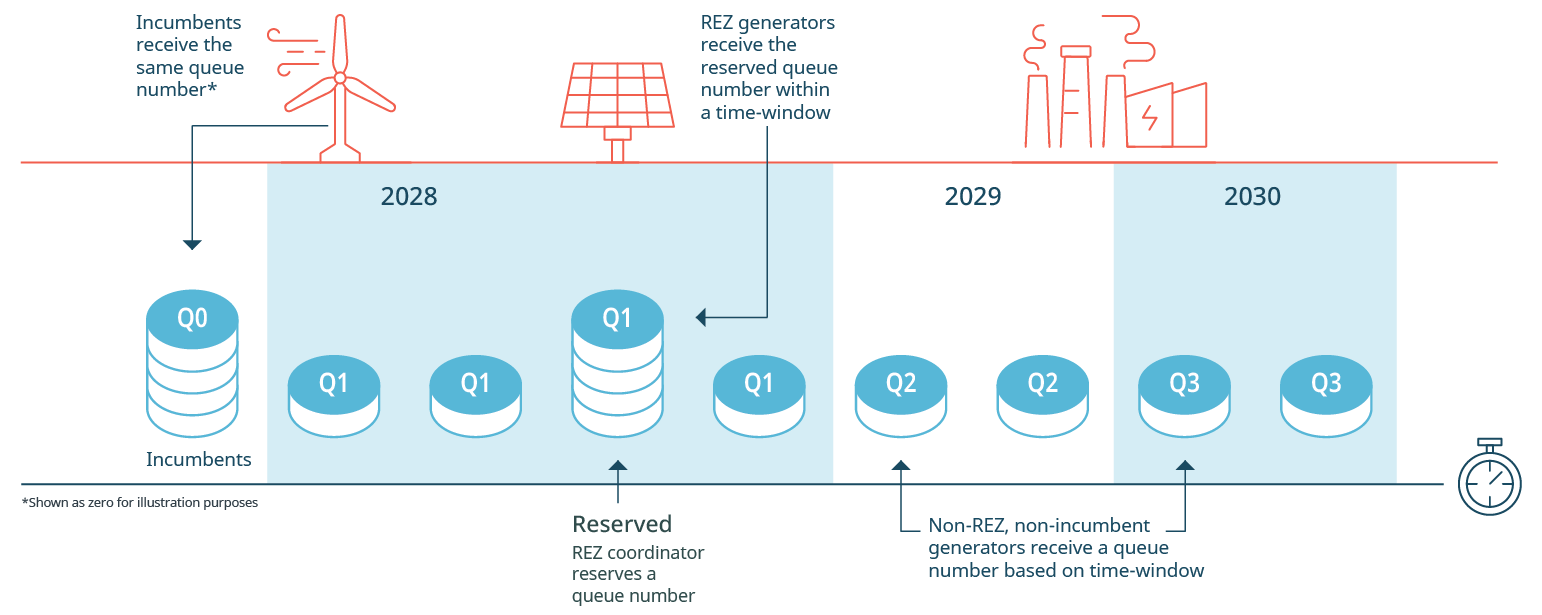

This model is a variation on the grouping by time-window approach. The REZ model operates as follows:

Limits would be implemented regarding what constitutes a REZ for the purpose of priority access.

The two-tier approach categorises generators into two categories. Legacy generators, committed generators and generators participating in REZ are grouped into a priority tier. Other new entrant generators are assigned a lower priority. Each category is mapped to a BFP.

The model has the option to implement a mechanism that enables other generators who are locating efficiently to be allocated into the priority group. Such assessment could be undertaken by government or by AEMO, based on modelling efficient hosting capacity in certain zones.

The three previous model options are "static" in that they are based on rules applied in planning timescales. An alternative is a "dynamic grouping" algorithm which is run close to, but before, real-time and is based on expected generation and transmission conditions. The algorithm would run sequential dispatches to progressively prioritise or deprioritise generators based on when they connect and whether their dispatch would need to be constrained.

"While AEMC considers that the grouping by time window option is the preferable priority access model, the Commission is seeking feedback as to whether stakeholders see merit in a dynamic grouping mechanism."

The AEMC paper includes significant detail on design options for priority access and the CRM. These need to be reviewed closely. Below we have highlighted the AEMC's preferred position for each option.

It is the AEMC's preference that the priority access model substantially grandfather legacy generators. Under this model legacy generators would be allocated the highest priority level. They also propose that once allocated priority, incumbent generators are treated the same as new generators. This preference is based on ensuring public policy decisions do not discourage future investors through the perception of increased regulatory risk.

Currently the AEMC plans to allocate a priority level late in the connections process, but before the final investment decision so as to ensure only genuine projects with a high probability of proceeding get allocated priority access while still providing investment certainty.

One of the objectives of transmission access reform is that it supports and strengthens jurisdictional REZ schemes. Currently the AEMC plans to allocate a priority level in the early-mid stage of the REZ development process and want to ensure generators who choose to participate in a REZ are allocated a higher priority than they would otherwise receive by connecting outside a REZ.

The second element to the proposed hybrid model is the CRM. Under the CRM, market participants can increase or decrease their dispatch. The mechanism promotes cost-based bidding over market floor prices, yielding more efficient physical dispatch through lower costs.

The CRM heralds three key design changes:

Given the voluntary nature of the CRM, market participants who elect not to opt into the mechanism will not experience any changes in this regard. Their dispatch outcome, as established in access dispatch, would be strictly 'locked' for physical dispatch. As a corollary, settlement continues to follow the RRP.

Energy revenue (Non-scheduled) = adjusted gross energy (AGE) x RRP

Conversely, CRM market participants submit two sets of bids: the first feeds into access dispatch and the second into physical dispatch. AEMC considers that this model will lower the costs of dispatch. Settlement will also change for CRM market participants.

Energy Revenue (Semi/scheduled) = AGE × RRP + (PQ - AQ) × (CRMP – RRP)2

There are two potential CRM implementation approaches – two-stage dispatch and a co-optimised dispatch proposed by the AEMC.

Two staged

Under the two-stage approach, dispatch runs one after the other, starting with access dispatch process and then physical dispatch (which is modified for those participating in the CRM). This model generates two sets of RRPs and accordingly, two choices for settlement. AEMC has expressed a preference for the access RRP which is calculated in priority access dispatch.

Co-optimised

The AEMC recognised flaws in the 2 stage process, and is developing a co-optimisation method. In brief, access and physical dispatch occur simultaneously. This minimises costs of dispatch costs and constraints, owing to its objective function.

The AEMC welcomes stakeholder views on these concerns.

In November 2023 Energy Ministers agreed to progress the agreed transmission access reform and congestion management through further design work. The Energy Ministers will consider the AEMC recommendations before making a decision as to whether to implement the hybrid model.

If a decision to proceed with the hybrid model is made by Ministers, a detailed implementation phase including developing draft rules would occur with corresponding consultation periods for stakeholders.

New priorities transmission access reform and the future of the National Electricity Market (17 May 2023)

The end of open access What the future holds for transmission access reform in the NEM (19 May 2022)

Authors: Dale Gill, Partner; Alexandria Brown, Lawyer; Murray Rissik, Graduate; Ethan Low, Paralegal; Cameron Saliba, Seasonal Clerk; Lauren Gunther, Seasonal Clerk; Ruby Ioannou, Seasonal Clerk.

1. Basis risk is a form of pricing risk whereby the income for a counterparty is no longer based on the price of the commodity that is the subject of the trade.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.