Sustainability disclosure requirements and labelling

09 November 2021

The big announcement from the FCA during COP26 was the discussion paper on sustainability disclosure requirements and investment labels (DP21/4).

The SDRs had already been trailed in the Greening Finance Roadmap, published by the UK Government in the lead up to COP26. However, DP21/4 provides much more detail to give relevant firms an understanding of what form the SDRs are likely to take, with a consultation due in Q2 2022.

While the rules being proposed under DP21/4 focus on disclosure requirements and labelling systems, the FCA also notes that it is considering the introduction of specific sustainability related requirements for firms and individuals which will aim to confirm that they should take sustainability matters into account in their investment advice and understand investors’ preference on sustainability to ensure their advice is suitable.

The idea is that the SDRs and sustainable investment labels will help both consumers and institutional investors make better informed decisions about their investments. The FCA want investors to make effective choices about sustainable investment products. To do so investors need sufficient, consistent information to be able to compare similar products and make considered choices.

The SDRs and sustainable investment labels will increase the provision of sustainability related financial information to consumers and stakeholders; and build trust in the market and help to combatpotential green washing, as well as play a role in educating consumers and encourage better management of sustainability risks.

Importantly, this information needed to help investors make better decisions includes information on how product manufacturers are managing sustainability risks, opportunities and impacts - both across their organisations and the products they manage, as well as details of the sustainability characteristics of individual investments.

The FCA makes it clear that its proposals apply to manufacturers rather than distributors and the focus will be on how the information will flow through the investment chain.

Ashurst comment: The scope of application to 'manufacturers' remains unclear as this will depend on the types of products that fall in scope. Clearly, funds themselves and manufacturers of funds will be caught. However, it is not clear whether MiFID instruments will also be in scope.

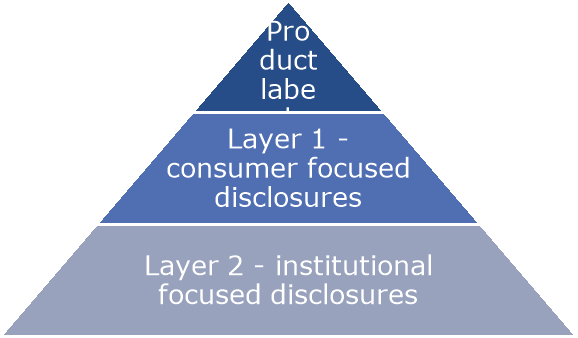

The proposals set out in the DP21/4 set out a system based on three categories of disclosures:

The FCA suggests that the approach could build on its existing TCFD aligned disclosure requirements through widening the scope.

The FCA considers (briefly) an approach that only applies to products which make sustainability claims but queries the efficacy of such approach.

The other (what seems to be preferred) approach is to develop a classification and labelling system that covers the full range of investment products available to retail consumers which the FCA considers would be more helpful to consumers to understand the sustainability characteristics of their investments.

This approach is similar to what is set out in the European Sustainable Finance Disclosure Regulation (SFDR) and the FCA maps out its proposed approach to the SFDR classification system.

The FCA makes it clear that the three categories of sustainable investments products (impact, aligned and transitioning) would be expected to pursue specific sustainability objectives, themes or characteristics alongside financial objectives.

Ashurst comment: The FCA's approach to the classification removes some of the uncertainty that we have seen under SFDR (particularly in relation to the threshold between article 6 and article 8) and gives a more realistic and logical approach with respect to environmentally focussed products. Clearly, lessons have been learnt from the European's approach.

The SDRs would apply at both product and entity level and the FCA intends to require disclosures to be made about how the firm is managing sustainability risks, opportunities, impacts as well as about the products themselves. The FCA suggests that some of these requirements will be wrapped up in the TCFD climate related disclosures requirements set out in its recent consultation and those proposals could be broadened so that they cover sustainability more generally (not just climate).

The FCA suggests two 'layers' of sustainability disclosure (summarised above) as well as additional disclosures relating to the entity.

Layer 1 would be consumer facing disclosures which would be more accessible to consumers and provide 'salient' information only.

1. Investment product label.

2. Objective of the product including specific sustainability objectives.

3. Investment strategy pursued to meet the objectives including sustainability objectives.

4. Proportion of assets allocated to sustainable investments (using UK Green Taxonomy).

5. Approach to stewardship.

6. Wider sustainability performance metrics (supported by context).

The FCA is considering embedding a baseline set of performance metrics to enable the consumer to understand the sustainable performance of the product over time (e.g. carbon reduction metrics and may include TCFD core metrics).

Investor education is a key challenge for the industry which the FCA recognises and will explore further.

Like its European counterpart, the UK regime is also likely to be based around a prescribed template (e.g. ESG fact sheet) which can be 'easily read alongside the KIID' (?!).

Layer 2 disclosures would be aimed at institutional investors and contain more detailed disclosures. These detailed disclosures would contain both product level and entity level information.

At product level, layer 2 disclosures may include:

1. Information on the methodologies used to calculate metrics (including the use of proxies and assumptions to fill data gaps);

2. Information on data sources, limitations and data quality;

3. Supporting narrative, contextual and historical information;

4. UK Green Taxonomy alignment; and

5. Information about benchmarks and performance.

At entity level, layer 2 is likely to incorporate information on the impact firms are having on the environment and society which is taken into account when selecting providers.

Again, the FCA intends to build on its TCFD disclosure requirements for asset managers and asset owners. Addressing the issue for global firms, the FCA acknowledges that there ought to be flexibility to allow firms to make disclosures at the level of consolidation which 'they consider is most decision useful for clients and consumers'.

A key driver for the FCA would be how the UK regime works in the context of other regimes, such as the SFDR and IFRS reporting ISSB sustainability standard.

The FCA makes it clear that this will be a regime that it will pay close attention to.

The FCA notes that providers will be responsible for their own classification of in scope products, but such classification will be considered and potentially challenged by the FCA, for example, when authorising new funds as well as during ongoing supervisory dialogue.

The FCA is also looking at the potential for independent verifiers to the classifications of products although acknowledge the impact on cost and capacity.

Ashurst comment: Of note is the omission by the FCA that it could use enforcement powers in tackling misuse of the classification system. This may be an express omission with the intention of keeping the focus positive, but clearly there is the possibility that enforcement action may be taken in the future.

For the moment, it looks like PAIS are not included in the FCA's proposals which will come as a relief to many. Nevertheless, the entity level disclosures may include data points which are similar to PAIS. We expect further information and detail on this will be published in the Q2 2022 consultation.

Most firms have now already considered sustainability and ESG. For buy side firms, it will be important to consider how any existing ESG strategy works in light of these proposals. It may also be useful to understand the gap between the SFDR requirements and the proposed SDR requirements.

Here at Ashurst we have run a gap analysis and can help with mapping that across.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.