Recent Reform of Nigerias Oil and Gas Industry Key Considerations

16 November 2021

16 November 2021

The regulatory reform of Nigeria's oil and gas sector has long been considered pivotal to the future development of the sector and to the broader economic objectives and development of the country. As Nigeria adopts an energy transition framework, a number of measures are being taken which will lead to lower carbon emissions from the oil and gas sector and help to fulfil the Federal Government of Nigeria’s (“FGN”) objectives of reaching net zero compliance by 2060, a commitment that President Buhari recently confirmed at the COP26 meetings in Glasgow.

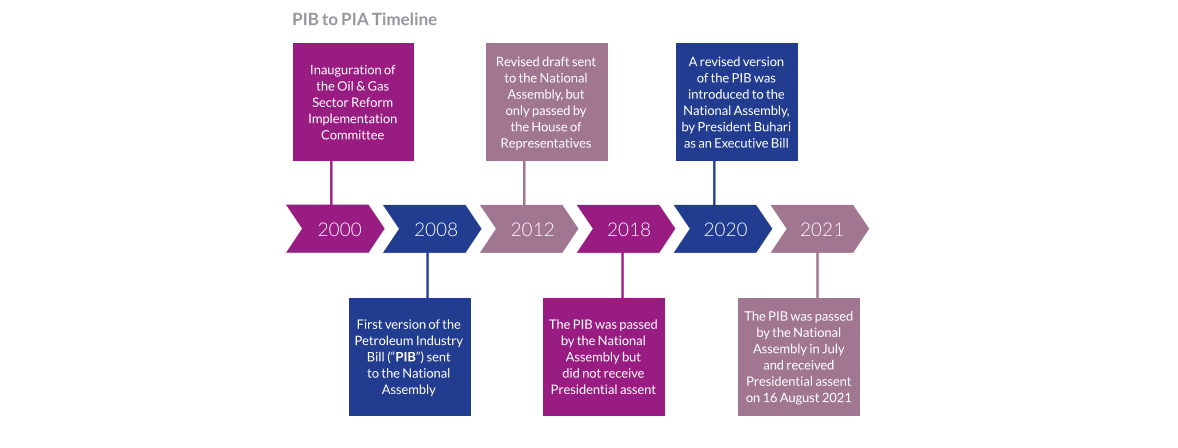

In recognition of the need to create a more investor-friendly environment and to pursue long-term growth, successive governments over the past 20 years have attempted to enact major reform to the oil and gas industry's the legislative framework. This has very recently resulted in President Buhari's successful drive to pass a bill to provide a revised legal, governance, regulatory and fiscal framework for the oil and gas industry and the development of host communities (the "Petroleum Industry Act” or the “PIA” or the “Act").

The PIA was passed by the National Assembly in July 2021 and following a consultative period to reach a consensus between the Senate and House versions, a consolidated version given assent by President Buhari on 16th of August and became law when gazetted on the 27th of August (the “effective date”).

Following the PIA becoming law, several developments have taken place which serve to implement its framework:

The PIA is an all-encompassing piece of legislation which will help to consolidate the major structural changes that the oil & gas sector has been undergoing for the past decade, namely:

This paper provides:

The process of reforming the oil and gas industry began with the inauguration of the Oil and Gas Sector Reform Implementation Committee in the year 2000.

It is important to note that the impact of continued regulatory and fiscal uncertainty, has been having a major detrimental effect on investment in the oil and gas sector, especially by the international oil companies (“IOCs”) delaying or cancelling commitments to develop critical deep water development projects.

2.2 Key Provisions

The PIA addresses the governance, licensing, operations, fiscal and host community aspects of upstream, midstream and downstream operations. Its implementation should provide a catalyst to attract much needed investment in the further development of the oil and gas industry. The following is an overview of the key provisions of the PIA.

The PIA replaces the Department of Petroleum Resources, with the regulation of the oil and gas industry being implemented through two bodies:

The New Funds

The Commission Fund and the Authority Fund are being established to fund the general operations of the Commission and the Authority.

Sources used to fund the Commission Fund include money appropriated by the National Assembly for the Commission, and fees charged by the Commission for services rendered to licensees and lessees.

Sources used to fund the Authority Fund include money appropriated by the National Assembly for the Authority, fees charged by the Authority for services rendered to licensees, lessees, permit holders, and other authorisations issued by the Authority, and a 0.5% levy on the wholesale price of petroleum products sold in Nigeria.

Sources used to fund the Midstream and Downstream Gas Infrastructure Fund also include a 0.5% levy on the wholesale price of petroleum products and natural gas sold in Nigeria, and funds and grants from multilateral agencies, bilateral institutions and related sources dedicated partly or wholly for the development of infrastructure for midstream and downstream gas operations in Nigeria. The main purpose of this fund is to make equity investments into FGN's participating or shareholder interests in midstream and downstream gas operations, with a view to improving private investment and increasing the domestic consumption of gas. This is an important provision as it is designed to further the FGN’s focus on the gas sector and supplement several of the other gas initiatives that have been adopted (Cf: Section 3 Energy Transition - Key Gas Policies below).

The Frontier Exploration Fund is funded from NNPC Limited’s (see below) 30% share of profit oil and gas, production sharing, profit sharing and risk service contracts. This fund is to assist the Commission in carrying out its functions with respect to exploration and development in frontier basins.

Creation of NNPC Limited

Over the past several years, there has been a concerted effort to improve transparency around the activities and finances of the Nigerian National Petroleum Corporation (“NNPC”), in an effort to create a more efficient and commercially viable company. Enabling NNPC to fund cash calls and resolve a number of outstanding issues with its JV partners, has resulted in NNPC participating in several IOC sponsored alternative funding structures which to date have raised over US$11bn.

The PIA positions NNPC to be effectively privatised and provides for the incorporation of the Nigerian National Petroleum Company Limited ("NNPC Limited"), as a company under the Companies and Allied Matters Act ("CAMA").

Ownership of all shares in NNPC Limited were vested in the FGN at its incorporation in September 2021 and are being held by the Ministry of Finance (“MoF”) and the Ministry of Petroleum (“MoP”) in equal proportions.

It is the intention of the FGN for NNPC Limited to operate as a truly commercial company, in a profitable and efficient manner, paying dividends to its shareholders and retaining 20% of its profits to develop its business, without recourse to government funds. Where NNPC Limited has a participating interest or 100% interest in a lease or license, it must pay its share of royalties, fees, rents, profit oil shares, taxes and any other required payments, to the FGN.

Transfer of Assets, Interests and Liabilities

The PIA provides that within eighteen months of the effective date, the Minister of Finance and the Minister of Petroleum will determine which assets, interests, and liabilities of NNPC will be transferred to NNPC Limited or its subsidiaries.

Incorporated Joint Ventures

The PIA gives NNPC Limited and its joint venture partners the option to restructure their joint venture arrangements as an incorporated joint venture (“IJV”), based on the principles set out in the Second Schedule of the PIA.

The PIA further provides that if companies elect to form an IJV, the IJV will at all times be the operator of oil and gas operations. While it may contract for specific petroleum services, it cannot enter into any contract or group of contracts which would have the effect of transferring either directly or indirectly, any of its functions as operator without the approval of the Commission or Authority.

The advantages to NNPC Limited of participating in an IJV include:

Licencing Regime

The PIA provides for a reform of the current upstream licencing regime and proposes that the Commission adopt a national grid system for acreage management based on the Universal Transverse Mercator system.

The PIA introduces a new licencing regime:

Although the Minister of Petroleum retains the authority to issue and revoke licences, such authority can only be exercised upon the recommendation of the Commission.

Licence Conversion

To enable a smooth transition, the PIA provides that the holder of an existing OPL or OML may enter into a voluntary conversion contract. Once concluded, the licensee or lessee under a conversion contract will be subject to the fiscal provisions contained in the PIA (Cf: Section 2.2.4 below).

A conversion contract is however to be concluded on the earlier of eighteen months from the effective date of the Act or the expiration date of the OPL or OML. However, where an existing licensee or lessee does not enter into a conversion contract, the terms applicable to their existing OPL or OML prior to the effect date of the PIA, shall continue to apply, including the current schedule of royalties.

The exact mechanism for licence conversion will be subject to further guidelines, to be issued by the Commission.

The practical consequence of the licence conversion provisions is that unless existing OPL and OML holders see a fiscal advantage to converting to the new licence structure, there will be a parallel royalty system in place.

Marginal Fields

It is important to note that with respect to producing marginal fields, the PIA provides that while such fields will be allowed to continue and operate under their original royalty rates and farm out agreements, they will convert to a PML within eighteen months from the PIA effective date. Where a marginal field has not been transferred to the government in three years from the effective date, the holder of the OML is to either:

(a) present a field development plan for the marginal field

(b) farm out the discovery with the consent of the Commission and on terms and conditions as the Commission may approve under regulations, or

(c) relinquish the field in accordance with the provisions of the PIA. Discoveries that have been transferred to the FGN however may be offered by the Commission as a PPL via a bid round

The proposed framework will allow for more flexibility in the operation, financing, and development of work programmes for the marginal field, which previously may have required the consent of the lessee(s) of the OML (i.e. the farmor) where the marginal field is located.

The PIA also provides that an interest in a PPL or PML cannot be assigned, novated, or transferred without the Minister's consent, on the recommendation of the Commission. Also, the PIA provides saving provisions which include the Petroleum Act 1969 and subsidiary regulation, which would imply that the 2021 provisions of the Guidelines and Procedures for Obtaining the Minister's Consent, may still apply under the PIA.

Gas Operations & Petroleum Liquids Operations

With respect to midstream and downstream operations, the PIA creates a split, with Chapter 2 Part IV of the Act providing for the administration of midstream and downstream gas operations, and Chapter 2 Part V of the Act providing for the administration of midstream and downstream petroleum liquids operations.

Gas Operations:

Accordingly, in respect to gas activities the Act provides for:

Petroleum Liquids Operations:

With respect to petroleum liquids operations the Act provides for:

A separate license is also required to establish, construct and operate a facility for the retail sale of petroleum products.

Decommissioning and Abandonment

The PIA provides new rules for decommissioning and abandonment. It requires that decommissioning and abandonment of facilities related to petroleum operations all adhere to good international petroleum industry practice and to the guidelines issued by the Authority or the Commission.

In order to address the historic underfunding of decommissioning and abandonment of oil and gas facilities, the PIA provides for a decommissioning and abandonment fund, held by a financial institution (that is not an affiliate of the licensee or lessee) in the form of an escrow account accessible by the Commission and the Authority. The fund, which is to be used exclusively for paying decommissioning and abandonment costs, is to be funded in accordance with the decommissioning and abandonment plan, which provides a reasonable estimate of the applicable decommissioning and abandonment cost (such estimate to be approved by the Commission or Authority, as the case may be).

Addressing the historic civil unrest in the Niger Delta has largely been through various agreements between oil companies and host communities, whereby the oil companies have provided a broad range of services and local projects under Global Memorandums of Understanding which have been enacted with host communities. In the year 2000, the FGN established the Niger Delta Development Commission for the socio-economic development of the Niger Delta region. The Ministry of Niger Delta Affairs was established in 2008 and in 2009 the Niger Delta Presidential Amnesty Programme was established in order to prevent the increased sabotage of oil & gas installations that had resulted in major production disruptions.

The objectives of the PIA in respect to host community matters include:

In this regard, the PIA requires that every oil company operating in the Niger Delta incorporates a trust for the benefit of the host community (the "Trust"). The oil company is then required to carry out need assessments and develop those into a community development plan that identifies the projects to be undertaken by the Trust.

The Trust will establish a fund, into which an amount equal to 3% of the oil company’s actual annual operating expenditure of the preceding financial year shall be set aside for the applicable host community. Any payment made by the oil company will be deductible for the purposes of the Hydrocarbon Tax and the Companies Income Tax as applicable.

Trust funds will be allocated as follows:

It should be noted that the 3% contribution to the Trust has and remains a contentious issue. The House version of the PIA had originally proposed a 5% contribution, versus the Senate version which was 3%. Despite intense lobbying from various host community organisations and state governors, President Buhari approved the lower amount, taking the risk that this could cause further unrest in the Niger Delta and disruption of petroleum operations.

In order to reform the current oil and gas fiscal regime and provide more clarity, the PIA eliminates the Petroleum Profits Tax and introduces a new tax structure comprising of:

Hydrocarbon Tax

The Hydrocarbon Tax is a new form of tax and only applies to upstream petroleum operations in relation to crude oil, condensate and NGLs produced from associated gas (“AG”).

The chargeable tax rate against the profits derived from operations are:

(a) 30% of profit from crude oil for PMLs with respect to onshore and shallow water areas

(b) 15% of profit from crude oil for onshore and shallow water and for PPLs

The Hydrocarbon Tax does not apply to deep offshore fields.

The PIA replaces the current Investment Tax Allowance and Investment Tax Credit with a production allowance and will apply to crude oil production:

from the commencement of production up to 500 million barrels, the lower of US$8.00 per barrel and 20% of the fiscal price of crude oil; and

after the cumulative maximum production of 500 million barrels, the lower of US$4.00 per barrel and 20% of the fiscal oil price.

In computing the adjusted profit on which the Hydrocarbon Tax is payable, oil and gas companies’ deductible costs will be capped at 65% of gross revenue. Deductible costs include:

PML or PPL rents

Company Income Tax

Companies involved in petroleum operations are subject to the provisions of the Companies Income Tax Act ("CITA"), the Hydrocarbon Tax will not be deductible for the purpose of determining company income tax, which will be charged at 30%.

It is also worth noting that in ascertaining the adjusted profit of a company engaged in upstream petroleum operations applicable to crude oil, deductions will not be allowed for bad debt and interest on borrowing, pension contributions, and all custom duties - provision for which formerly existed under Section 10 of the Petroleum Profits Tax Act ("PPTA").

Thus, the PIA clearly seeks to establish a new tax regime separate from the preceding regime under the PPTA where petroleum profit tax was set at 85%, or 65.75% for the first five years of a company's start of regular oil and gas production.

Another key difference is that the PPTA was applicable exclusively to companies involved in petroleum operations (typically upstream), whereas the fiscal provisions of the PIA apply to companies involved in upstream, midstream and downstream petroleum operations, without prejudice to the provisions of CITA.

Royalties

With respect to the payment of royalties, the applicable regime is governed by the provisions of the Seventh Schedule of the PIA which empowers the Commission to receive royalty in kind or in cash at its discretion.

Crude oil and condensate royalties are to be based on terrain, production and on price, while natural gas and NGL royalties are only based on production, see tables below:

There is no royalty by price for frontier acreage, and royalties which come from "royalty by price" are to be for the credit of the Nigerian Sovereign Investment Authority.

The PIA royalty rates will only apply to those companies that elect to convert their existing OMLs to PMLs. Otherwise OML licensees will continue to pay royalties as set under the PPTA.

Gas Pricing

The PIA effectively establishes gas as a standalone hydrocarbon and proposes a new gas pricing framework.

In terms of regulating commercial gas prices, each year the Authority will determine the domestic base price pursuant to the Third Schedule of the Act. The Authority is granted power to determine prices, if in its opinion, control of prices for natural gas for the strategic sector is required.

Additionally, the PIA provides that:

(i) the price being at a level to incentivise natural gas supplies for the domestic market on a voluntary basis by the upstream petroleum industry

(ii) subject to (i), the price will not to be higher than the average of similar natural gas prices in major emerging countries that are significant producers of natural gas

(iii) subject to (ii), the price will be adjusted upwards on a yearly basis to account for inflation on a yearly amount percentage basis

(iv) the price to be determined by the Authority within three months following the effective date, and the price to be modified if required

It should be noted that gas sale agreements relating to domestic sales or exports entered into prior to the effective date of the Act, are entitled to continue unaltered until their termination. The new gas pricing regime may, depending on the domestic base price set by the Authority, warrant parties under existing gas supply agreements to reconsider the economics of their existing gas contracts and adjust them for the new gas pricing regime.

Reference has been made in this paper to the FGN’s concerted effort in the past few years to promote the development and commercialisation of natural gas for domestic use in preference to the majority of gas which was exported via NLNG. In this respect, the government has continued its effort in ensuring that Nigeria becomes a gas-powered economy, by implementing certain gas specific policies.

Therefore, it is important both in the context of the PIA and the overall development of the oil & gas sector, to focus on how the FGN is promoting the development of gas, as this provides a significant opportunity for international and domestic companies and investors.

The development and utilisation of gas continues to be a major issue for the administration of President Buhari, as seen from his declaration of 2020 as the 'Year of Gas' and 2020-2030 'Decade of Gas' declaration.

More recently under the auspices of the COP26 meetings in Glasgow, FGN and the administration of President Buhari have continued to emphasize the importance of gas as a transitional fuel, and to ensure a stable energy transition in Nigeria, and indeed across the African continent. This view has gathered important public supporters in the region, including the African Development Bank (AfDB). Nevertheless, it remains to be seen if statements by President Buhari that Nigeria can continue to use gas until 2040 (without diverting from the goals of the Paris Agreement) is intended to set a deadline that may result in refinements to the current policies.

Key policies that underscore these gas-centric economic objectives are set out below and include:

During his first term, President Buhari introduced a framework to increase domestic gas commercialisation. The first step was the launch of the “7 Big Wins” initiative, followed by the restructuring of NNPC in July 2016.

This led to the creation of two operating subsidiaries under the Nigerian Gas Company:

In June 2017 the FGN approved the National Gas Policy (“NGP”). The NGP replaced the Gas Master Plan of 2008 and was designed with the sole objective of moving Nigeria from an oil-based economy to an oil and gas-based industrial economy. The NGP with respect to pricing, is a fiscal framework that recognises gas as a standalone commodity separate from oil.

The implementation of the NGP as well as the legislative framework provided under the PIA, are critical for the country to move away from an oil dependent economy. We are of the view that with key stakeholders of the industry actively promoting the objectives of this policy, both foreign and local private investment into the gas sector is on the rise. A number of upstream gas and major infrastructure projects are under development which will increase the availability and use of gas in the country’s industrial and commercial hubs. In turn these will serve as catalysts for the development of other gas-related industries such as power, agriculture and other industrial projects.

A key feature of the NGP is to eliminate gas flaring through gas utilisation projects. The Flare Gas (Prevention of Waste and Pollution) Regulations of 2018 (the "Gas Flaring Regulation") seeks to achieve a similar goal and reduce the environmental and social impact caused by the flaring of natural gas. In 2002 flared gas accounted for 53% of AG produced from petroleum operations, but by September 2020, flared gas only accounted for 7% due to a number of factors including:

The Gas Flaring Regulation further vests the FGN with the right to take AG free of cost at the flare without payment of royalty or to allow a qualified applicant to take such flare gas on behalf of the FGN. The Regulation further provides for a permit regime, whereby those with a 'Permit to Access Flare Gas' may, on an exclusive basis, take flare gas from sites designated in the permit and utilise it or otherwise dispose of it, in an authorised manner.

The Regulation sets a fee of $2.00 mscfd of flared gas for fields producing over 10,000 bopd, and $0.50 mscfd of flared gas for fields producing less than 10M bopd. No payment is to be made in respect of agreed volumes of flare gas that a producer has committed to deliver to a permit holder under a Deliver or Pay Agreement.

Implementation of the Gas Flaring Regulation and in particular the award of permits via the competitive auction process has to date been limited due in large part to:

The National Gas Expansion Programme is aimed at promoting greater use of CNG and LPG. In August 2020, the Central Bank of Nigeria ("CBN") allocated NGN 250 billion (~US$60m) under an intervention facility to help fast-track the adoption of the programme and fund the establishment of:

The passage of the PIA represents the conclusion of 20 years of political initiatives to provide much needed reform of the regulatory, institutional and fiscal structure of the oil & gas sector. It provides clarity on the regulatory & fiscal environment and provides international and indigenous oil & gas companies with a degree of certainty from which to formulate and execute oil & gas development plans, especially in the highly prolific deep water.

Wood Mackenzie estimate that ~30% or ~11bn bbls of Nigeria’s total proven oil reserves are controlled by the IOCs. Onshore and shallow water divestment programmes by the IOCs are being undertaken with a view to focusing on projects in the deep water (e.g. Shell’s Bonga Southwest, ExxonMobil’s Owowo).

The PIA provides clarity on deep water fiscal terms and is expected to auger a new round of IOC deep-water FID applications.

The PIA, in combination with other recently adopted policies and legislation, provides a defined roadmap for the commercialisation and utilisation of Nigeria’s ~200Tcf of AG and NAG reserves for domestic use, which is essential to the country’s economic diversification and development.

The focus on host community development and the establishment of funds specifically targeted at improving both the environment in the Niger Delta and the livelihood of host communities impacted by oil & gas operations, is a positive impact of the PIA. Host community initiatives that have long been a feature of oil & gas operations in the Niger Delta will be expanded and should go further in alleviating the social and political unrest that has frequently impacted oil & gas operations.

Implementation of the primary provisions of the PIA and especially the restructuring of NNPC as a truly commercial, non-state-controlled entity will take time and will undoubtedly be faced with internal political and institutional roadblocks. However, the PIA does represent the regulatory, institutional and fiscal reform that the oil & gas sector has long sought. This will aid the further exploitation of Nigeria’s significant oil & gas reserves and resources and progress the FGN target of increasing proven crude oil reserves from ~37bn barrels to 40bn barrels and production from ~2MM bopd to 3MM bopd.

As an item to watch in the coming months, President Buhari has reaffirmed Nigeria's commitment to reaching net zero compliance by 2060 at the COP26 meetings in Glasgow, and this may lead to further supportive clarifications on the pathway that Nigeria is on, and how the PIA and its implementation will support this.

This article has been a joint collaboration between Ashurst LLP and Michael Humphries of Redcliff Energy Advisors. It summarises our understanding of the issues discussed but does not constitute legal, accounting or financial advice and should not be relied on without discussions with us and, where appropriate, Nigerian lawyers.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.